Join our 30 Day Macro-Fundamental Challenge and

UNLOCK TRADING OPPORTUNITIES

Created by the Federal Reserve

I’m not trying to assign blame but…

This man might just be responsible for the most economic pain the world has felt in the last 15 years.

And create a number of incredible trading opportunities along the way.

That pain is just starting to bite.

U.S. companies have already laid off hundreds of thousands of workers with more cuts planned by the end of the year.

60% of Americans are living paycheck to paycheck.

Doesn’t feel normal does it?

I’m sure you’ve heard about SVB – the bank that collapsed overnight? Then followed by Signature Bank and First Republic.

That man is responsible. And he was just trying to do his job!

You see, many analysts believe we are on the brink of an “everything bubble” that is ripe and ready to pop.

It all started in 2008, when two Bear Stearns hedge funds collapsed and Lehman Brothers filed for the largest bankruptcy in US history.

It all started in 2008, when two Bear Stearns hedge funds collapsed and Lehman Brothers filed for the largest bankruptcy in US history.

Financial institutions were left holding trillions of dollars in near worthless subprime mortgages.

So Congress created a 700 Billion dollar Bailout called TARP to help save the financial system.

They cut rates to near zero and started an unprecedented program called quantitative easing.

In March 2009 – 2010, the Fed purchased 200 billion in agency debt and 1.25 trillion in mortgage-backed securities and 300 Billion in long term treasury debt.

On November 3rd 2010, the Fed announced an additional 600 Billion of purchases of treasuries and on September 13th, 2012 monthly purchases of 40 Billion in mortgage backed securities.

In 2012, the federal reserve cranked up the money printer again purchasing 85 Billion in monthly purchases of agency debt and mortgage backed securities.

Rates were already low, but the Federal Reserve reinstated QE4 and so on March 15th 2020 they agreed to begin purchasing 120 Billion dollars per month of agency debt and mortgage backed securities.

Rates were already low, but the Federal Reserve reinstated QE4 and so on March 15th 2020 they agreed to begin purchasing 120 Billion dollars per month of agency debt and mortgage backed securities.

This quantitative easing and money spent does not include nearly 4.5 Trillion dollars spent in response to COVID.

It also does not include the yearly deficit spending from the US government.

It also does not factor in similar printing and quantitative easing from central banks across the world.

And so…

Stocks started trading at outrageous multiples… interest rates were reduced to near zero and many started taking out cheap loans.

The money was so cheap that banks started charging a negative interest rate just to keep your money at their bank for some large institutions.

Companies bought back their stock and borrowed money to buy back more.

After all, if you are borrowing for near 0% and are making 10% returns on your stock buybacks…why wouldn’t you?

This is why the last 15-30 years has been the golden age of passive investing.

Simply throw your money in an index fund and watch the market appreciate by a tidy 10% per year.

The companies of the world were staggering around in a drunken stupor of excess cash.

But those days are behind us.

Jerome Powell knows the predicament he’s in.

Inflation and the devaluation of the currency on the one hand or aggressively raising rates and causing massive pain to real people on the other.

He’s made his choice and I honestly didn’t think he’d have the backbone to do it.

Even after the downtick in inflation just a couple weeks ago the Fed revised up AGAIN interest rate expectation by another 50bps at the latest dot plot meeting.

He’s worried about the trillions of dollars in liquidity sloshing around our system.

So Powell has pulled out his bubble popping needle and got to work cutting down every bubble that he can get his hands on.

This is a phenomenal opportunity for active investors not seen in a generation.

First, a word of caution:

Let me make something abundantly clear:

The ideas and financial strategies that we talk about are only for people willing to look at money in a different way than we’ve all been taught…

You’ve been taught to take your money and hide it away in a 401k or in a “passive” index fund.

Then when you retire, your “nest egg” will be ready.

If you aren’t open to changing the entire way you think about investing, you should probably stop reading right now.

I don’t want to offend anyone.

But for those of you who are open to consider alternatives…

Listen up!

Why?

Because the Federal Reserve Rate hikes are going to BREAK parts of the global world order.

Causing pain for regular people and opportunities for a select few.

Here at Financial Source we are on the cutting edge and don’t want your portfolio to get left behind.

So in July we’ll be kicking off our 30 Day Macro Fundamental Challenge!

The goal of this…

- Reveal key macro fundamental investing opportunities created by the Federal Reserve.

- Give you sentiment and technical insights to help with trade timing.

- And follow along as I place my own Macro Fundamental Trades in July.

The live sessions each day will be made up of 2 parts. A presentation with Q&A and then a discussion on what trades we are currently looking to trade in July.

It’s going to be fun analyzing all these events and showing you how I prepare for them. Recordings will be made available if you can’t make it to the live events.

Live Sessions will begin at 10am EST/ 1500 hrs

With live day trading sessions starting 15 minutes before the new release.

Monday 3rd July

Understanding the mysteries of the Federal Reserve

Tuesday 4th July

Swing Trade: The 200% opportunity on Copper

Wednesday 5th July

Swing Trade: The opportunity on the JPY

Thursday 6th July

Swing Trade: When is gold’s window to explode?

Friday 7th July

Day Trading: jobs print (1315BST release)

Monday 10th July

Swing Trade: The Nikkei 225 opportunity no one is talking about

Tuesday 11th July

Day Trading: UK Labor data (0645BST release)

Wednesday 12th July

Day Trading: US CPI (1315BST start)

Thursday 13th June

Top seasonal opportunities for August

Friday 14th July

Define a trend (1500BST start)

Monday 17th July

Must know candlestick patterns

Tuesday 18th July

Day Trading: CAD inflation data (1315BST start)

Wednesday 19th July

Day Trading: UK Inflation data July (0645BST release)

Thursday 20th July

The trick to marking support and resistance levels

Friday 21st July

How to use trendlines to spot reversals

Monday 24th July

An introduction to seasonal patterns

Tuesday 25th July

Using pivot points & symmetrical triangles

Wednesday 26th July

Bonus session: Hottest AI stocks of the summer and fall 2023

Thursday 27th July

Day Trading: US Core PCE (1315BST release)

Friday 28th July

Bonus session: Top funding platform options

By the way, we got a 10% return on one of our AI stock picks earlier in the year, by following some of the techniques in our July 26th bonus session.

You also might be interested in our July 28th bonus session.

We’ll be discussing a funding platform that I just passed 2 key evaluation criterion using macro fundamental day trades and how you can get involved.

And another platform that requires you to make 10% over 12 months to get funded…with minimal strings.

I’ll also show you a couple of funding platforms to avoid like the plague.

Now I can’t say whether you’ll make a hundred, a thousand, or a million dollars following this 30 Day Macro Fundamental Challenge or even if it’s right for you…

But I can tell you we’ve tracked the macro trades that we’ve taken already this year with some pretty impressive results.

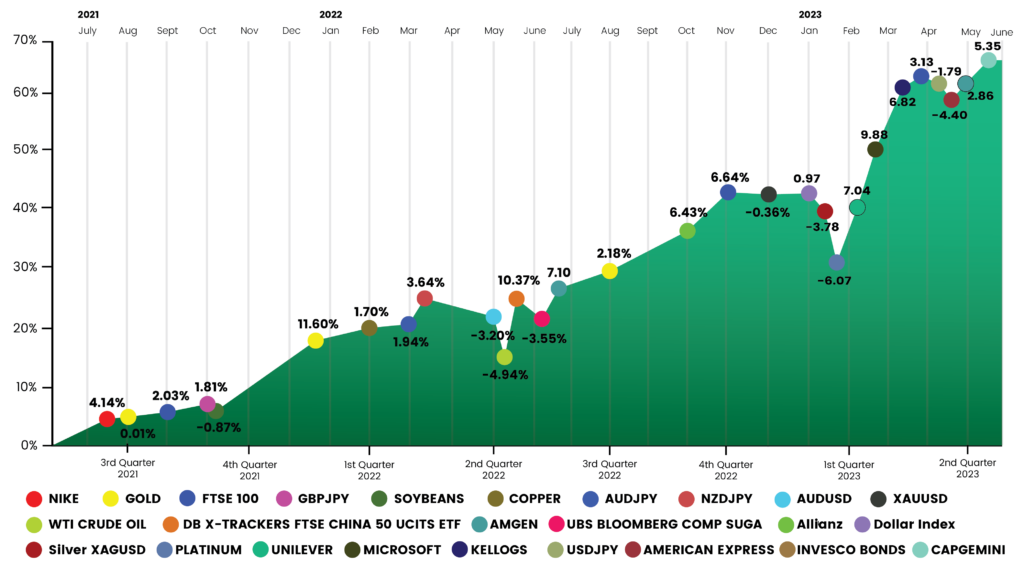

We are currently up hundreds of points in our macro fundamental and seasonal swing trading – check the chart below.

Many of you have also been following my macro-fundamental day trades where 8 of the last 10 trades have been winners.

If you think 30 days of macro-fundamental training can improve your trading…

Then click below to sign up – $397 to enter our 30 Day Macro Fundamental Challenge!

Our products and commentary provides general advice that do not take into account your personal objectives, financial situation or needs. The content of this website must not be construed as personal advice.